What Every Service provider Must Learn About Bid Bonds Prior To Bidding

Wiki Article

Necessary Actions to Utilize and get Bid Bonds Effectively

Browsing the intricacies of quote bonds can substantially influence your success in securing agreements. The real obstacle exists in the meticulous selection of a reliable supplier and the critical use of the proposal bond to enhance your affordable side.Recognizing Bid Bonds

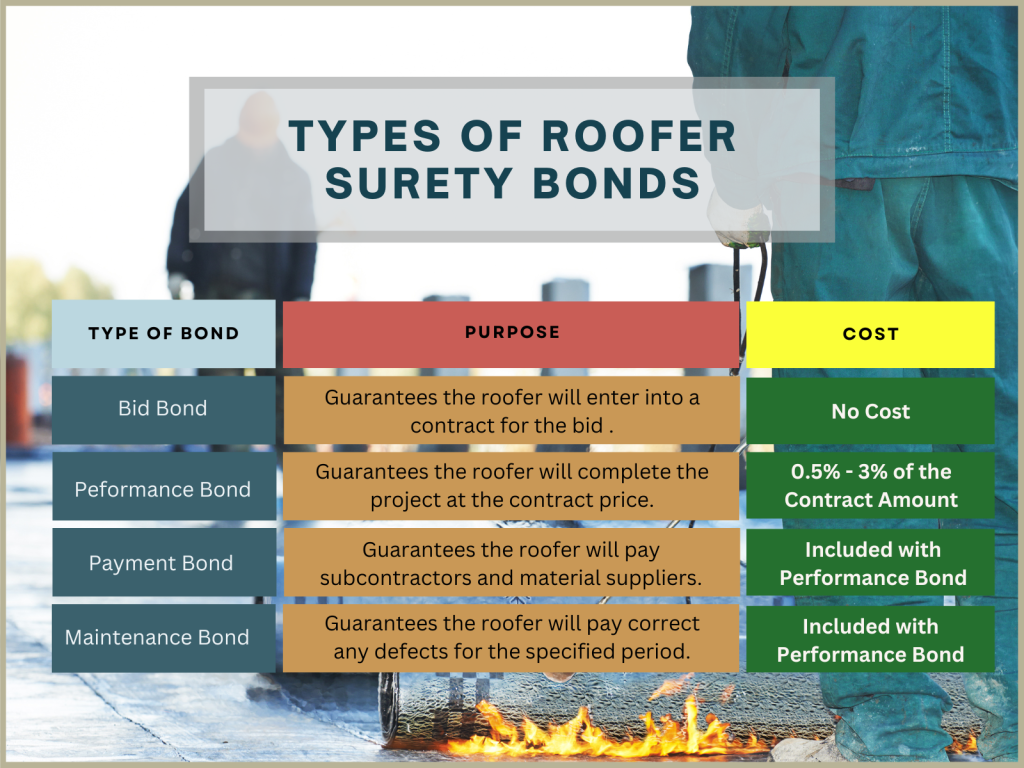

Bid bonds are a vital element in the building and construction and having industry, offering as a financial assurance that a prospective buyer intends to participate in the agreement at the proposal rate if granted. Bid Bonds. These bonds minimize the danger for job owners, making sure that the selected professional will certainly not only recognize the proposal however also secure efficiency and payment bonds as requiredEssentially, a bid bond serves as a protect, securing the job owner against the economic implications of a service provider failing or taking out a bid to begin the project after choice. Normally issued by a guaranty business, the bond warranties settlement to the owner, often 5-20% of the quote quantity, need to the specialist default.

In this context, bid bonds foster a much more credible and competitive bidding process atmosphere. They oblige specialists to present sensible and significant proposals, recognizing that a punitive damages looms over any kind of breach of commitment. These bonds guarantee that only economically secure and reliable specialists get involved, as the extensive credentials process by guaranty business screens out less reputable bidders. As a result, bid bonds play a crucial duty in preserving the honesty and smooth procedure of the building bidding procedure.

Planning For the Application

When getting ready for the application of a bid bond, meticulous organization and detailed documents are paramount. An extensive testimonial of the job specs and quote needs is vital to guarantee conformity with all stipulations. Start by constructing all necessary monetary declarations, consisting of annual report, revenue declarations, and capital statements, to show your firm's monetary wellness. These documents should be current and prepared by a certified accountant to enhance trustworthiness.

Next, assemble a list of previous tasks, especially those similar in extent and size, highlighting successful completions and any type of accreditations or awards got. This profile functions as proof of your company's capacity and reliability. In addition, prepare a detailed business plan that details your operational method, threat administration practices, and any backup plans in position. This strategy offers an all natural sight of your company's method to project implementation.

Make sure that your service licenses and enrollments are up-to-date and easily offered. Having actually these files organized not only accelerates the application procedure yet likewise projects an expert picture, instilling self-confidence in prospective guaranty suppliers and task owners - Bid Bonds. By carefully preparing these elements, you place your business favorably for successful bid bond applications

Discovering a Surety Service Provider

A surety firm familiar with your field will certainly better understand the distinct threats and requirements linked with your jobs. It is likewise a good idea to examine their monetary rankings from companies like A.M. Best or Criterion & Poor's, guaranteeing they have the monetary stamina to back their bonds.

Involve with several suppliers to compare services, terms, and rates. An affordable analysis will aid you safeguard the ideal terms for your bid bond. Eventually, a detailed vetting procedure will certainly make certain a trustworthy collaboration, fostering confidence in your proposals and future jobs.

Sending the Application

Submitting the application for a bid bond is a vital action that needs thorough focus to information. This procedure begins by collecting all pertinent paperwork, consisting of financial statements, task specifications, and a thorough service history. Making sure the precision and completeness of these files is vital, as any kind of inconsistencies can lead to rejections or hold-ups.

When filling in the application, it is a good idea to double-check all entrances for accuracy. This consists of validating numbers, ensuring correct trademarks, and confirming that all necessary attachments are included. Any omissions or mistakes can threaten your application, creating unneeded difficulties.

Leveraging Your Bid Bond

Leveraging your proposal bond properly can dramatically boost your one-upmanship in Full Report securing contracts. A bid bond not only shows your financial stability yet additionally assures the project owner of article source your dedication to fulfilling the agreement terms. By showcasing your bid bond, you can underscore your firm's reliability and reputation, making your bid stand out among many rivals.To take advantage of your bid bond to its max possibility, guarantee it is presented as part of a thorough proposal package. Highlight the toughness of your guaranty supplier, as this mirrors your company's monetary health and operational ability. Additionally, stressing your performance history of effectively completed projects can additionally infuse confidence in the task proprietor.

Moreover, keeping close interaction with your surety provider can promote far better terms and problems in future bonds, therefore strengthening your affordable positioning. An aggressive method to handling and renewing your bid bonds can additionally avoid gaps and make sure continuous coverage, which is essential for recurring job procurement efforts.

Verdict

Efficiently utilizing and acquiring bid bonds requires thorough prep work and calculated execution. By thoroughly arranging key paperwork, picking a respectable guaranty provider, and sending a total application, companies can secure the see here required quote bonds to boost their competition.

Identifying a trusted surety company is an essential step in protecting a quote bond. A bid bond not just demonstrates your monetary stability yet also assures the project owner of your dedication to satisfying the agreement terms. Bid Bonds. By showcasing your bid bond, you can highlight your firm's reliability and credibility, making your bid stand out among numerous rivals

To utilize your quote bond to its maximum potential, guarantee it is provided as part of a thorough bid bundle. By adequately organizing key documents, choosing a credible surety company, and submitting a complete application, firms can safeguard the needed quote bonds to enhance their competitiveness.

Report this wiki page